CUSTOMS TOGETHER

What do we do

CUSTOMS TOGETHER

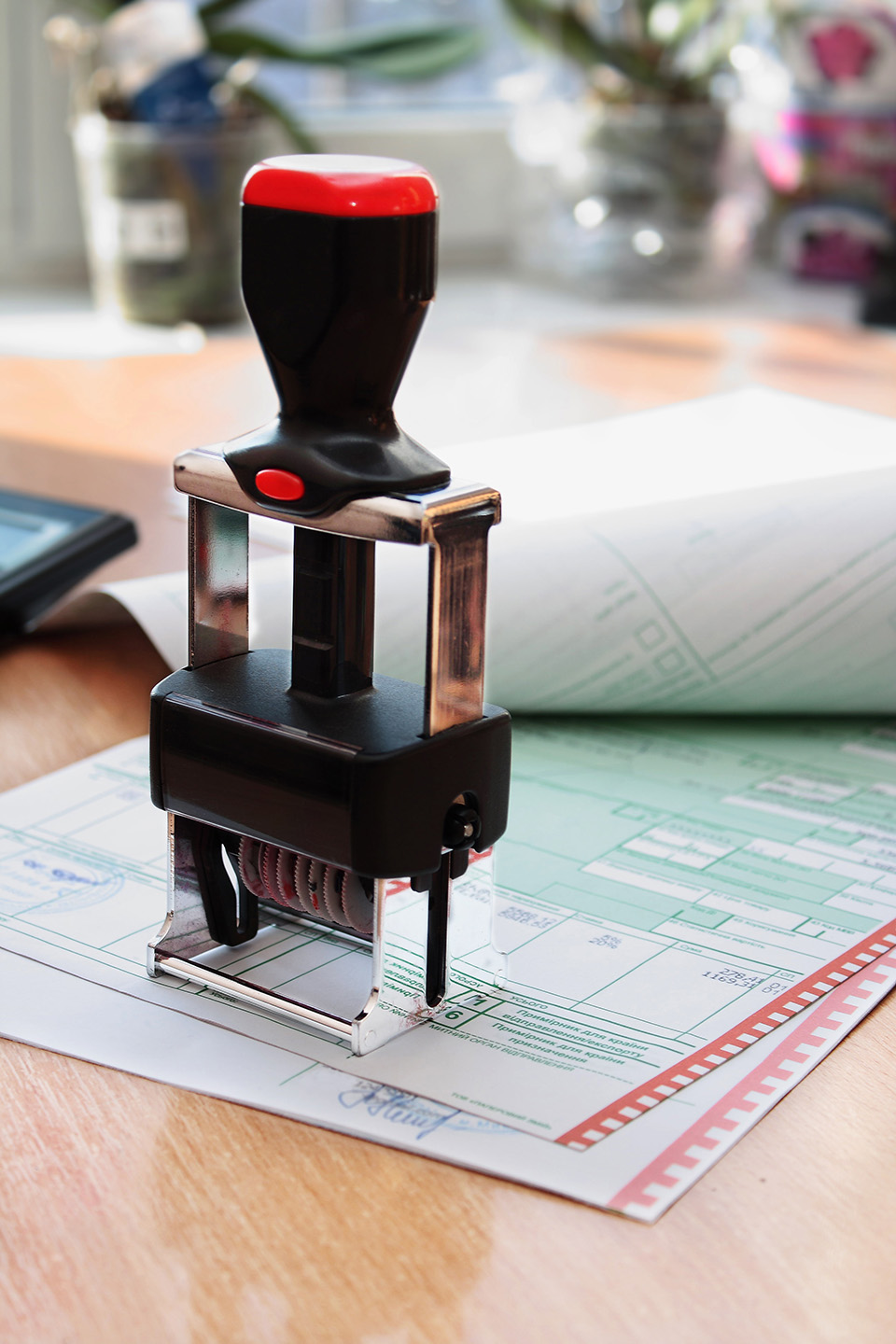

Customs formalities

Almost all customs formalities are offered by Customs Together.

If you import your goods, we will help you with the import declaration. Please keep in mind that customs duties may have to be paid. VAT is payable immediately after import As an importer, there are options to postpone the payment of VAT. With some products certificates are required. Make sure you keep the original certificates in your possession. It is always possible to calculate the import costs in advance.

Conversely, we also offer our services for export. We are happy to prepare an export declaration. As an exporter, you must also take into account the conditions for export. Sometimes permission is required or proof that your product does not require permission. You should always be well prepared.

There is also the option of not importing products directly at the border. You can then use a Transit document. With this document you can move products to a Bonded warehouse (customs warehouse) or to a domestic customs office for importation locally. You can defer payment of customs duties and VAT until the products will proceed to their final destination.

Working together with

Customs

Dutch

Food- and

Consumer Product Safety

Portbase

C-point

CUSTOMS TOGETHER

NVWA

Are you importing foodstuffs, in many cases you have to report to the health authorities (NVWA) at the border. The NVWA’s task is to ensure that the foodstuffs do not threat a health risk. The NVWA’s task is to ensure that the foodstuffs do not threat a health risk.

A Common Entry Document (GDB) must be drawn up on arrival of meat or animal products. We take the entire process off your hands.

From reporting the NVWA to taking care of inspections. The customer is taken care of from start to finish.

CUSTOMS TOGETHER

Certificates

Although there are more and more trade agreements between different countries/regions where a REX(Registered Exporter) number is sufficient to prove the origin, there are still enough destinations where the origin must be proven in another way.

The Chamber of Commerce in the Netherlands is involved for a certificate of origin. However, not everyone can just apply for a certificate of origin. This can only be done digitally. Customs Together is connected and can apply for all certificates of origin.

In addition to origin, there is also provenance. The difference is not very complicated. The origin is the place where the product was produced. Provenance is the place where the products come from (and were cleared there) before they arrive at the destination. For example: Chairs are produced in Mexico and then shipped to the United States. From the United States the chairs are shipped again to the Netherlands. The origin is (and remains) Mexico and the provenance is the United States.

Some destinations require proof of origin. For example Turkey. There is a trade agreement with Turkey. When goods come from free circulation in the European Union with an A.TR document (provenance document), A reduction of import duties can be obtained.

CUSTOMS TOGETHER

Consultancy

Activities in customs are not always as simple and clear as it seems. But it is very important topic of world trade. In many situations processes have to be adjusted to meet the requirements of customs.

It is therefore good that you are well informed about this or receive guidance in aligning your processes with the conditions of customs.

Customs Together believes that an investment in knowledge and information always will be recovered soon.

CUSTOMS TOGETHER

Matthieu van Dijke

Founder

Rotterdam, the Netherlands

In my 20 year career in the world of transport I have experienced a lot and I know the ropes. I have worked in almost all areas of logistics. Growing up on an inland vessel I have seen almost all of Western Europe from the water. I know many ports from inside and out.